Owning a hardware wallet does not automatically make you secure; it just changes your primary threat from a failing exchange to your own operational errors.

- True security is a rigorous, ongoing process (Operational Security or OpSec), not a one-time product purchase.

- Once you take custody, the greatest risks become compromised seed phrases, overlooked smart contract permissions, and flawed recovery plans.

Recommendation: Immediately adopt a “zero-trust” security model for your own assets, assuming every interaction is a potential attack vector and verifying everything.

You wake up one morning and the exchange holding your life’s savings has frozen withdrawals. The app won’t load. The CEO’s Twitter account has gone silent. For millions, this nightmare became a reality with the collapse of platforms like FTX, vaporizing wealth and trust in an instant. The crypto space is littered with the digital corpses of exchanges, and the common refrain echoes in their wake: “Not your keys, not your coins.” This advice, while true, is dangerously incomplete. It’s the first step on a path riddled with new, more personal, and often more insidious threats.

Simply buying a hardware wallet and scribbling down a seed phrase is not a security strategy; it’s a false sense of security. It’s like buying a high-tech vault but leaving the key under the doormat and the combination written on a sticky note. The real work of self-custody—of achieving true digital sovereignty—is in building a fortress of paranoid, meticulous operational security (OpSec). It’s about understanding that once you remove the counterparty risk of an exchange, you become your own single point of failure. Your mission is no longer to trust a third party, but to relentlessly mistrust everything else, including your own habits.

This guide discards the platitudes. It is a technical, paranoid manual for treating your digital assets like state secrets. We will move beyond the “what” and drill down into the “how” and “why” of professional-grade OpSec. We will dissect the process of establishing a secure perimeter, testing its resilience, and managing the ongoing risks of interacting with the decentralized world. This is not about simply holding your crypto; it’s about building an impenetrable system to protect it from every conceivable threat.

To achieve this level of security, we will systematically dismantle the process into its core components. This article provides a clear roadmap, from understanding the fundamental rule of sovereignty to mastering the advanced tactics required in today’s threat landscape.

Summary: The Paranoid’s Guide to Crypto Security

- Why “Not Your Keys, Not Your Coins” is the only rule that matters?

- How to set up a hardware wallet and back up your seed phrase correctly?

- Hot Wallet vs. Cold Wallet: balancing convenience with security for daily use

- The smart contract approval mistake that drains wallets in seconds

- Staking rewards: how to earn yield on your crypto while keeping custody?

- How to run a pilot program for blockchain integration with minimal risk?

- Why “zero-commission” trading apps might actually cost you more in spread?

- Angel Investing 101: Understanding Venture Capital Dynamics for Individuals

Why “Not Your Keys, Not Your Coins” is the only rule that matters?

The phrase “Not Your Keys, Not Your Coins” is not a catchy slogan; it is the most fundamental, immutable law of the cryptocurrency universe. It describes the technical reality of blockchain assets. When you hold your assets on a centralized exchange, you do not own cryptocurrency. You own an IOU, a promise from a company that they will give you your assets when you ask for them. This introduces counterparty risk: the danger that the other side of your agreement will fail to uphold their end of the bargain. This isn’t a theoretical risk. The collapse of FTX saw customer losses estimated at over $8 billion, a catastrophic failure of a trusted counterparty.

Holding your private keys means you have direct, permissionless control over your assets on the blockchain. There is no intermediary, no CEO, and no customer service department that can freeze your account, deny a withdrawal, or lose your funds in a bad trade. Your ownership is cryptographically guaranteed and enforced by a global, decentralized network. This is the entire premise of Bitcoin and the revolution it started: the separation of money from state and corporate control.

However, this absolute control comes with absolute responsibility. When you take custody, you are the bank. You are the security team. You are the one and only person responsible for your assets. There is no password reset button, no fraud department to call if you make a mistake. Every threat that a bank or exchange protects you from—hackers, internal fraud, operational errors—now becomes your problem to solve. This is why understanding this rule is only the beginning. It’s the “why” that necessitates the paranoid “how” that follows.

How to set up a hardware wallet and back up your seed phrase correctly?

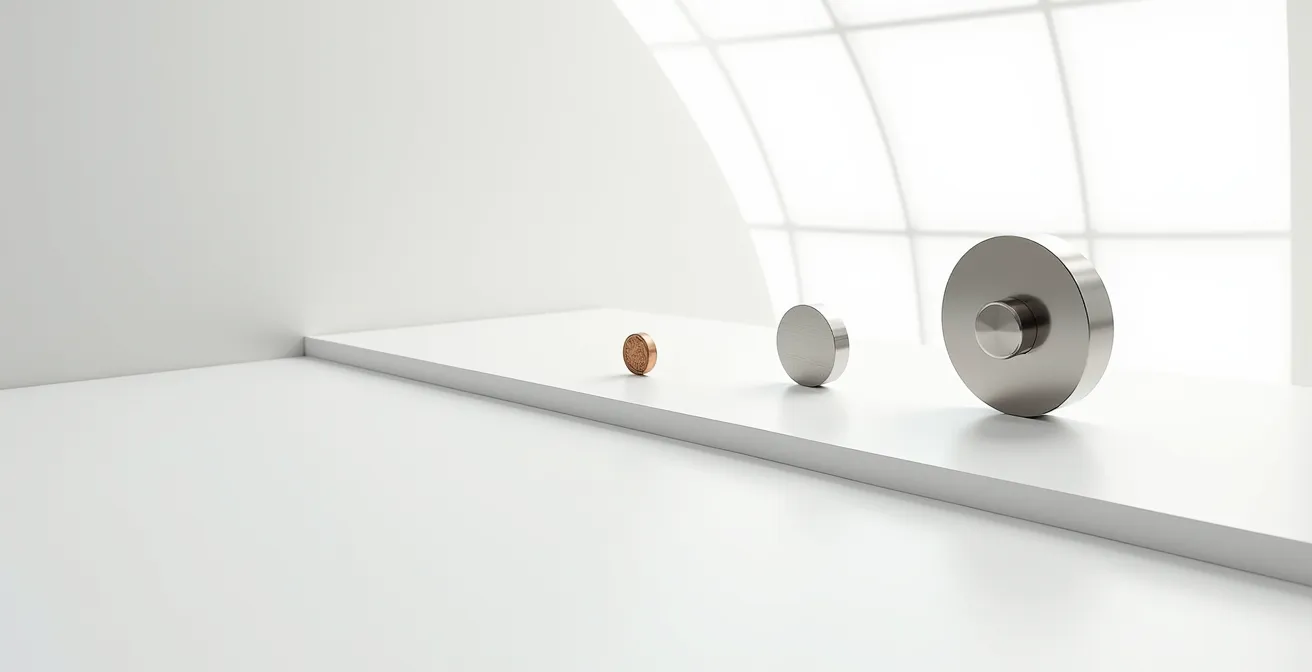

A hardware wallet, or cold wallet, is a specialized device designed to keep your private keys isolated from internet-connected devices. This is your primary defense, your digital vault. But the device itself is worthless without a bulletproof protocol for its setup and, more importantly, its backup. Your seed phrase (or recovery phrase) is the master key to all your crypto. If your device is lost, stolen, or broken, this sequence of 12 or 24 words is the only way to restore access. Protecting it is your single most critical security task.

Forget writing it on a single piece of paper. Amateurs write it on paper. Professionals engrave it in steel and plan for every disaster scenario: fire, flood, theft, and even their own memory loss. The goal is to eliminate any single point of failure (SPOF). Your backup strategy must be resilient and redundant without expanding your attack surface. Storing your seed phrase digitally—in a text file, a password manager, or a cloud drive—is asking for total financial ruin. It must be kept offline, always.

The level of paranoia you apply should be proportional to the value you are protecting. A one-size-fits-all approach is a sign of a weak security posture. As this table shows, your backup method must evolve as your portfolio grows, moving from basic redundancy to advanced cryptographic schemes that distribute risk. As one analysis on self-custody best practices outlines, the method should scale with the stakes.

| Portfolio Value | Storage Method | Security Level | Recovery Complexity |

|---|---|---|---|

| Less than $1,000 | Paper backup in 2 secure locations | Basic | Low |

| $1,000 – $50,000 | Steel plate backup (fire/water resistant) | Enhanced | Medium |

| Over $50,000 | Shamir’s Secret Sharing or Multi-sig | Advanced | High |

Finally, a backup is not a backup until it has been tested. The most critical, and most often skipped, step is the “fire drill.” You must simulate a total-loss event to verify that your recovery plan works. Hope is not a strategy.

Your Hardware Wallet ‘Fire Drill’ Protocol

- Set up your new hardware wallet and generate your seed phrase.

- Send a micro-transaction (e.g., $5 worth of crypto) from an exchange to your new wallet address.

- Confirm the funds have arrived. Now, deliberately wipe the hardware wallet, returning it to factory settings.

- Restore the wallet using ONLY your physical seed phrase backup. Do not use any digital copy.

- Confirm the funds are accessible again. If they are, your fire drill was a success. You have a verified backup.

Hot Wallet vs. Cold Wallet: balancing convenience with security for daily use

Not all funds require the Fort Knox-level security of a cold wallet. A practical security model involves segmenting your assets based on their intended use, a strategy that balances convenience with a minimized attack surface. Think of it like your traditional finances: you don’t carry your entire life savings in your pocket. You have a checking account for daily spending and a savings account for long-term wealth.

A hot wallet is any crypto wallet connected to the internet (e.g., a mobile or browser extension wallet). Its keys are stored on a device that is constantly exposed to potential threats. This is your “pocket money” for daily transactions, DeFi interactions, or displaying NFTs. The amount stored here should be small enough that its total loss would be an inconvenience, not a disaster. A warm wallet, often a browser extension on a dedicated, hardened computer, can be your “working capital” for more significant but still active DeFi engagement. Your cold wallet (hardware wallet) is your vault or savings account. This is where the vast majority of your assets—anything you don’t plan to touch for weeks, months, or years—must reside, completely air-gapped from the internet.

A robust strategy involves defining clear rules for how much capital is allocated to each tier and when to move funds between them. This tiered approach is a core principle of personal crypto OpSec:

- Cold Storage (Hardware Wallet): 80-95% of your portfolio. This is your long-term hodl stack. It should require significant physical effort to access.

- Warm/Hot Storage (Desktop/Mobile Wallet): 5-20% of your portfolio. This is your “checking account” for trading, staking, and DeFi.

- Exchange Holdings: Less than 5%, and only for the duration of a trade. This is not storage; it is a high-risk transit zone.

This segmentation drastically reduces your risk. If your hot wallet is compromised, the damage is contained. The bulk of your wealth remains secure in cold storage, untouched and offline.

The smart contract approval mistake that drains wallets in seconds

Once you venture beyond simple holding and into the world of Decentralized Finance (DeFi), NFTs, or airdrops, you encounter a new and devastating threat: malicious smart contracts. Every time you interact with a dApp (decentralized application), you are asked to sign a transaction that grants it permission to interact with the tokens in your wallet. The most dangerous of these is the “infinite approval,” which gives the contract permission to withdraw an unlimited amount of a specific token from your wallet at any time in the future, without further confirmation. Statistics show this is not a niche problem; one report found over 150 contract attacks in 2024 leading to hundreds of millions in losses, many exploiting this exact mechanism.

Hackers create malicious dApps or exploit vulnerabilities in legitimate ones to drain funds from every wallet that has granted an infinite approval. You might interact with a site once for a simple NFT mint, and months later, your wallet is emptied because you never revoked that permission. This is the digital equivalent of giving a stranger a signed blank check. Managing these approvals is a non-negotiable part of your ongoing security routine. You must adopt a “zero-trust” approach: grant permissions sparingly, for the minimum amount necessary, and revoke them immediately after you’re done.

For risky or one-time interactions, the best practice is to use a dedicated “burner” wallet. This is a separate hot wallet with a small, disposable amount of funds. If it’s compromised, your primary wallets remain safe. The following audit is not optional; it’s a mandatory, recurring process for anyone interacting with dApps.

Action Plan: Your Quarterly Permissions Audit

- Points of Contact: List all dApps, NFT marketplaces, and protocols you have connected your wallet to in the past.

- Collect: Use a trusted tool like Revoke.cash or your blockchain explorer’s approval checker to inventory every active token approval for your wallet address.

- Coherence: Scrutinize the list. Do you still use this platform? Is the company still reputable? Confront each approval with your current activity and trust level.

- Risk Assessment: Identify all “unlimited” approvals. Prioritize these as high-risk, as they represent the biggest potential for a catastrophic drain.

- Plan of Integration: Systematically revoke all approvals for dApps you no longer use, especially those from one-time NFT mints or forgotten projects. Set a calendar reminder to repeat this audit every 90 days.

Staking rewards: how to earn yield on your crypto while keeping custody?

The desire to earn yield on your assets should not force you back into the arms of risky centralized platforms. It is entirely possible to stake your crypto and earn rewards while maintaining full self-custody. This is known as “non-custodial staking,” and it allows you to participate in network security and earn yield without ever handing over your private keys. The two primary methods for this are native staking and liquid staking.

Native staking involves locking your tokens directly in the protocol’s smart contract and delegating them to a validator. You retain full ownership, but your tokens are typically subject to an “unbonding” period if you wish to withdraw them. Liquid staking involves using a third-party protocol (like Lido or Rocket Pool) that stakes your tokens on your behalf and gives you a derivative token (a Liquid Staking Token or LST) in return. This LST represents your staked position, accrues rewards, and can be freely traded or used in other DeFi protocols, providing liquidity where native staking cannot.

Each method has distinct trade-offs between complexity, security, and yield. As a comparative analysis of staking methods highlights, liquid staking introduces additional smart contract risk, as you are now trusting both the base layer protocol and the liquid staking provider.

| Feature | Liquid Staking (LST) | Native Staking |

|---|---|---|

| Liquidity | Immediate – can trade staked tokens | Locked – unbonding period required |

| DeFi Composability | Yes – use in lending/DEXs | No – tokens locked in protocol |

| Security | Additional smart contract risk | Direct protocol security only |

| Complexity | Simple – like holding tokens | Complex – validator selection needed |

| Yield | Slightly lower (fees) | Full staking rewards |

If you choose native staking, your most important task is due diligence on validators. Delegating to a malicious or incompetent validator can lead to “slashing,” where a portion of your staked assets is destroyed as a penalty. Your research should be relentless:

- Commission Rate: A rate between 5-10% is standard. 0% can be a red flag (unsustainable), and 100% is a scam.

- Uptime: Demand at least 99% uptime. Frequent downtime means lost rewards.

- Self-Stake: The validator should have a significant amount of their own funds staked (“skin in the game”).

- Reputation: Research their community engagement, transparency, and history.

- Decentralization: Avoid delegating to the largest validators to help maintain network health.

How to run a pilot program for blockchain integration with minimal risk?

In the corporate world, before a company goes all-in on a new technology, it runs a pilot program to test assumptions, identify risks, and validate the approach on a small scale. You must apply this exact same discipline to your personal self-custody strategy. Your “pilot program” is your initial, deliberate, and cautious entry into the world of digital sovereignty. Rushing this process is how catastrophic mistakes are made.

The goal of your pilot program is to gain hands-on experience and build muscle memory in a low-stakes environment. This is not about theory; it’s about practice. The program should have distinct phases, each with a clear objective. The first phase is purely educational: research hardware wallets, understand the difference between models, and learn the fundamentals of cryptographic security. Do not purchase anything yet. Your only investment is time.

The second phase is implementation and testing. This is where you acquire your hardware wallet and run the “Fire Drill” protocol described earlier. The key here is to use a trivial amount of money—an amount you would not be upset to lose. This test transaction is the most important part of your pilot. It validates your entire hardware, software, and backup chain. If you can’t successfully send, receive, wipe, and restore $5, you have no business managing $50,000. This process reveals flaws in your understanding before they become expensive lessons.

Only after a successful pilot program should you proceed to the “production” phase: gradually migrating a larger portion of your assets from exchanges to your now-verified self-custody setup. This phased approach transforms a daunting leap into a series of manageable, low-risk steps, replacing fear with tested confidence.

Why “zero-commission” trading apps might actually cost you more in spread?

The “zero-commission” model popularized by modern trading apps is a powerful marketing illusion. While you may not pay an explicit fee, you often pay a hidden cost through the bid-ask spread. The app quotes you a buy price slightly above the market rate and a sell price slightly below it, capturing the difference as profit. It’s a fee disguised as the market price. This teaches a critical lesson for anyone in crypto: the most significant risks are often the ones that are not explicitly disclosed.

There is a direct and terrifying parallel in the world of crypto custody. Centralized exchanges offer the “zero-commission” equivalent of convenience. They make it effortless to buy, sell, and store your assets. There is no complex setup, no seed phrases to secure, no fire drills to run. This convenience is the lure. The hidden “spread,” however, is not a few basis points on a trade; it is the 100% counterparty risk you are unknowingly accepting. The true cost of using an exchange for storage is the non-zero probability that it will collapse and take all your assets with it.

The illusion of “free” or “easy” is the most potent threat to your wealth. Whether it’s a hidden spread on a stock trade or the unstated risk of an exchange’s insolvency, the principle is the same. A paranoid mindset requires you to question every transaction and ask, “What is the real cost here? What is the hidden risk I am not seeing?” In self-custody, there are no hidden costs. The cost is explicit: it is the time, effort, and relentless diligence required to be your own bank. It is a high price, but unlike the hidden risk of custodians, it is one you have complete control over paying.

Key Takeaways

- Sovereignty is a discipline, not a product. Your security depends on your operational rigor, not just your hardware.

- Always test your backup and recovery plan with a “fire drill” before you need it. An untested backup is not a backup.

- Segment your assets across hot, warm, and cold wallets to minimize your attack surface and contain potential losses.

Angel Investing 101: Understanding Venture Capital Dynamics for Individuals

An angel investor who writes a check to a startup understands one thing perfectly: the risk of total loss is high, and they are solely responsible for their due diligence. They don’t blame the market if the startup fails; they analyze what they missed in their own assessment. To truly succeed in self-custody, you must abandon the consumer mindset and adopt the ruthless, accountable mindset of an angel investor. You are not buying a product; you are making a venture investment in your own security apparatus.

First, conduct due diligence as if your life savings depend on it—because they do. A VC investigates a startup’s team, technology, and market. You must investigate your hardware wallet’s source code, the reputation of its manufacturer, and the known attack vectors against it. You must vet staking validators by checking their uptime, commission, and on-chain history. Every decision must be backed by deep, skeptical research, not by a YouTuber’s recommendation.

Second, embrace total responsibility. When an angel’s investment goes to zero, there is no bailout. When your self-custody setup fails, there is no one to sue. There is no insurance policy for forgetting your seed phrase or clicking a malicious link. This mindset is terrifying, but it is also empowering. It forces a level of seriousness and discipline that is impossible when you rely on a third party for protection. You are the CEO, CTO, and CISO of You, Inc.

Finally, engage in active management. A good angel investor doesn’t just write a check and disappear; they monitor the company’s progress and offer guidance. You must actively manage your security posture. This means conducting quarterly permission audits, staying informed about new threats, and continuously evaluating and upgrading your protocols. Your security is not a “set it and forget it” system. It is a dynamic battleground that requires your constant vigilance.

The path to digital sovereignty is a deliberate and demanding one, but it is the only way to be immune to the systemic failures of centralized finance. Start today by running your pilot program. Treat your security with the seriousness of a venture capitalist, and build a system that you, and only you, control.