The future value of your property isn’t in its smart thermostat, but in the unseen infrastructure backbone connecting it to the city’s nervous system.

- Future-proof fiber optic and 5G access, built on open architecture, is the most critical value driver, not proprietary smart home gadgets.

- A property’s connection to open data ecosystems for safety and traffic insights is becoming a tangible, bankable asset for investors.

- Ecosystem resilience, demonstrated through smart landscaping and heat island mitigation, is shifting from an aesthetic bonus to a quantifiable-and-valuable feature.

Recommendation: Focus your property assessment on infrastructure scalability and data accessibility, not just on current smart home features, to avoid investing in a property that will be structurally obsolete in five years.

As an urban homeowner or real estate investor, the term “smart city” likely conjures images of app-controlled lighting and talking refrigerators. The prevailing wisdom suggests that packing a property with the latest gadgets is the surest way to increase its appeal and value. This leads many to focus on the visible, consumer-facing technology, believing that a smart home is the ultimate goal. But what if this focus is a costly distraction?

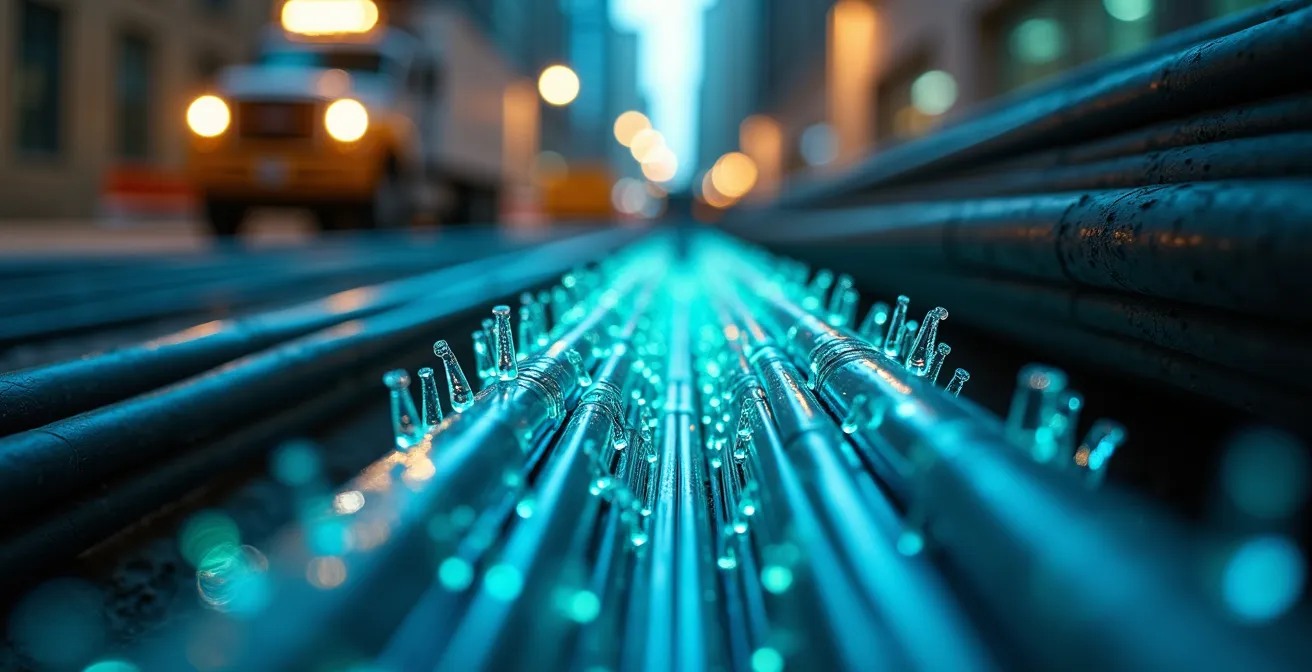

The real story of property value in the cities of tomorrow is being written in the unseen layers beneath our feet and in the invisible signals that travel through the air. The true measure of a property’s long-term economic viability lies not in its collection of smart devices, but in its connection to the city’s fundamental infrastructure backbone. This is about the quality of the digital plumbing—the fiber optic conduits, the 5G cell density, and the open data policies—that will determine a property’s relevance and resilience for decades to come.

This article moves beyond the superficial layer of smart technology to provide a visionary yet economically grounded analysis. We will dissect the core infrastructure pillars that are actively reshaping real estate valuation. By understanding these powerful, often invisible, forces, you can learn to identify properties poised for significant growth and avoid those destined for structural obsolescence.

To help you navigate these complex dynamics, this analysis is structured to explore the most critical factors influencing future property values, from connectivity and data to privacy and sustainable design. Here is a breakdown of what we will cover.

Summary: The Core Drivers of Real Estate Value in a Smart City

- Why homes in 5G-enabled neighborhoods are selling 15% faster?

- How to access open government data to improve your neighborhood’s safety?

- Smart surveillance or privacy: determining the trade-off in gated communities

- The infrastructure mistake developers make that renders “smart” condos obsolete in 5 years

- When to buy in a gentrifying smart district: identifying the early signals

- Why buyers make up their mind within the first 7 seconds of seeing a property?

- Why your concrete patio is creating a heat island effect in your backyard?

- How Landscaping Improvements Can Increase Real Estate Valuation by 15%?

Why Homes in 5G-Enabled Neighborhoods Are Selling 15% Faster?

The speed at which a property sells is a direct indicator of its desirability, and next-generation connectivity is emerging as a primary catalyst. In an increasingly digital world, robust 5G and fiber optic access are no longer amenities; they are essential utilities, as critical as water or electricity. For homeowners and investors, this digital infrastructure backbone represents a property’s capacity to support future technologies, from autonomous vehicle communication to advanced telehealth services. A home without high-speed, low-latency connectivity is effectively cut off from the future economy.

The market is already pricing in this reality. A deep dive into real estate trends reveals that this isn’t just about faster streaming. It’s about a property’s fundamental economic viability. As a case in point, Singapore’s massive investment in its smart infrastructure, totaling $43.5 billion, has directly translated into a premium real estate market where connected properties command significantly higher prices. This government-led push created an environment where efficient transport, smart housing, and green buildings are the norm, making the city a magnet for investment.

This premium is backed by hard data. Research from the McKinsey Global Institute confirms the tangible impact of this infrastructure, predicting that smart city technology can increase property values by 10-20%. This isn’t a speculative bubble; it’s a market correction that recognizes a property’s capacity to participate in the digital future. For investors, verifying a property’s connectivity score and researching planned 5G rollouts is now a non-negotiable step in due diligence, as crucial as a structural inspection.

How to Access Open Government Data to Improve Your Neighborhood’s Safety?

In a smart city, data is the new currency for community empowerment and investment security. Municipal governments are increasingly making vast datasets public through open data portals. This information—spanning everything from 311 service requests and crime statistics to traffic incidents and building permits—provides an unprecedentedly clear view of a neighborhood’s health and trajectory. For a homeowner or investor, this is no longer abstract information; it is a powerful tool for due diligence and risk mitigation, transforming data into a tangible asset.

Instead of relying on anecdotal evidence or outdated reports, you can now conduct your own granular analysis. For instance, by cross-referencing reports of broken streetlights with data on petty crime, you can pinpoint specific, actionable safety gaps and lobby local officials for targeted improvements. The Dallas Smart City pilot project serves as a powerful example: by integrating data from new LED streetlights, environmental sensors, and public Wi-Fi, the city was able to demonstrably reduce crime in a targeted neighborhood, proving the direct link between smart infrastructure and community safety.

This data-driven approach allows you to move beyond marketing claims and verify a property’s true quality of life. You can check emergency service response times, monitor noise complaints to predict neighborhood disputes, and even gauge community engagement by analyzing citizen-science data. Leveraging this information is a proactive strategy to not only improve your immediate environment but also to safeguard and enhance your property’s long-term value. It’s about making investment decisions based on evidence, not assumptions.

Smart Surveillance or Privacy: Determining the Trade-Off in Gated Communities

The conversation around surveillance in residential communities is often framed as a simple binary: security versus privacy. However, in the context of a smart city, the calculus is far more sophisticated, involving economic factors like insurance premiums, legal liability, and resident control. The decision is no longer about whether to install cameras, but about what kind of data ecosystem a community chooses to build. As the security experts at Palo Alto Networks note, this digital nervous system is both a smart city’s greatest strength and its most significant vulnerability.

This is where the concept of “privacy-by-design” becomes a critical differentiator in property value. Traditional surveillance systems, which record continuously and use active facial recognition, create a high-risk environment for privacy breaches and legal challenges. In contrast, modern systems are engineered to prioritize privacy, a feature that insurers are beginning to reward. These systems anonymize data by default, only de-blurring footage with explicit and auditable approval from a homeowners’ association (HOA), and provide residents with granular control over their personal data.

The economic implications of this choice are profound. As the following comparison shows, a privacy-first approach can directly translate into lower costs and reduced risk, making a community more attractive to discerning buyers who value both safety and autonomy.

This table, based on an analysis of secure smart city systems, breaks down the tangible differences for a homeowner’s association or property manager.

| Feature | Traditional Surveillance | Privacy-by-Design Systems |

|---|---|---|

| Data Storage | Full video recordings | Anonymized metadata only |

| Face Recognition | Always active | Blur by default, reveal only with HOA approval |

| Insurance Impact | Standard reduction | 15-20% premium reduction |

| Legal Liability | High risk of privacy lawsuits | Reduced liability with audit trails |

| Resident Control | No opt-out option | Granular privacy preferences |

As the Palo Alto Networks Security Team states in their report, “Building Secure Smart Cities in the Age of 5G and IoT”:

The interconnectivity in smart cities is both their greatest strength and greatest weakness.

– Palo Alto Networks Security Team, Building Secure Smart Cities in the Age of 5G and IoT

The Infrastructure Mistake Developers Make That Renders “Smart” Condos Obsolete in 5 Years

The single most expensive mistake a real estate investor can make in a smart city is buying into a property with a closed, proprietary technology ecosystem. Many developers, aiming for a “smart” label, install integrated systems from a single vendor. While this may seem convenient initially, it creates a deadly trap: structural obsolescence. When that vendor stops supporting the technology or goes out of business, the entire building’s smart functionality—from access control to climate systems—can become an unfixable, unsupported liability. The “smart” condo becomes a “dumb,” and significantly devalued, asset in as little as five years.

The key to avoiding this pitfall lies in the building’s underlying infrastructure. A future-proof property is built on an open API architecture. This allows for the continuous integration of new technologies from various vendors, ensuring the building can evolve as technology advances. The Edge in Amsterdam is a prime example of this philosophy in action. It utilizes tens of thousands of sensors, but its true genius lies in its open platform, which prevents vendor lock-in and guarantees its long-term relevance and value.

For an investor, assessing a building’s technological foundation is therefore paramount. This goes beyond checking for smart thermostats and into the core of its design: Does it have sufficient conduit capacity for future bandwidth needs? Are its systems based on open standards? Is there a clear plan for software updates and long-term maintenance? A “no” to these questions is a major red flag, signaling a property with a built-in expiration date.

Your Future-Proofing Checklist: Critical Infrastructure Requirements

- Conduit Capacity: Verify that the building has installed conduit capacity planned for at least 10 times the current bandwidth requirements.

- Open Architecture: Confirm the building management system operates on an open API, not a proprietary, closed-loop system, as recommended by a study on future-proof digital infrastructure.

- Expandable Server Rooms: Assess if server rooms are designed modularly with capacity for future edge computing hardware.

- Electrical Load: Ensure the electrical infrastructure is designed to handle at least a 50% increase in load to accommodate future technologies.

- Maintenance & Updates: Check for budgeted, long-term software update and maintenance contracts with technology partners.

- Partner Commitment: Research the technology partners to ensure they have a public commitment to long-term support and backward compatibility.

When to Buy in a Gentrifying Smart District: Identifying the Early Signals

Timing is everything in real estate investment, and this is especially true in emerging smart districts where property values can escalate rapidly. The key is to identify the “leading indicators”—the subtle, on-the-ground signals that a neighborhood is on the cusp of a technology-driven transformation, before the market fully prices it in. These signals are not found in real estate brochures but in municipal databases and the physical streetscape.

The most powerful early indicator is the rollout of foundational infrastructure. Tracking municipal permit databases for major fiber optic installations and 5G small cell deployments is like seeing the blueprints for future growth. These investments are the non-negotiable precursors to a true smart district. The sight of crews installing these cables is a clear buy signal for a savvy investor. As the global smart cities market is predicted to grow to $3.7 trillion by 2030, being early to these districts is how significant returns are generated.

Other crucial signals include a shift in the type of public service requests. When 311 calls change from complaints about potholes to inquiries about EV charging station availability, it indicates a demographic and technological shift. Likewise, the increasing density of co-working spaces, the designation of an area as a public-private “innovation district,” and the installation of smart parking meters are all tangible signs that a neighborhood’s economic and digital profile is changing. By monitoring these indicators, an investor can move from speculating to making a data-backed decision, entering the market at the optimal moment.

Why Buyers Make up Their Mind Within the First 7 Seconds of Seeing a Property?

The notion that a home buyer’s decision is made in moments is not just a real estate aphorism; it’s a cognitive reality. While a full financial and structural analysis follows, the initial emotional response is overwhelmingly powerful. According to cognitive research, buyers form their initial property impression within 7 seconds. In a smart property, this crucial window is where technology can create an immediate, visceral sense of an “easier life.”

This isn’t about flashy, complex features. It’s about seamlessness. When a potential buyer enters a property and the lights gently ramp up, the climate adjusts to a comfortable temperature, and music begins to play softly, the technology becomes invisible. It doesn’t present itself as a gadget to be learned, but as an environment that anticipates and serves their needs. This experience creates a powerful first impression of modern comfort, sophistication, and, most importantly, a well-maintained property where things simply work.

This immediate feeling of ease and quality has a direct economic impact. Studies on properties with integrated smart home features show they not only command higher prices but also higher rents. The perceived value of connectivity and sustainable design, often linked to operational expense reductions of up to 35%, is something buyers are willing to pay a premium for. The first seven seconds are a silent negotiation, and a home that demonstrates effortless technological competence wins that negotiation before a single word about price is spoken.

Why Your Concrete Patio Is Creating a Heat Island Effect in Your Backyard?

While we often think of smart technology in digital terms, one of its most valuable applications is in managing the physical environment. Your traditional concrete patio, for instance, is likely an unrecognized liability. Dark, non-permeable surfaces like concrete and asphalt absorb and retain solar radiation, creating a “heat island” that can make your backyard 8-15°F hotter than surrounding green areas. This not only impacts your comfort and energy bills but is also becoming a factor in municipal policy and, consequently, property valuation.

Cities are now using thermal satellite imaging to map these heat islands and are beginning to consider interventions, such as “heat taxes” on properties that contribute excessively to the problem. This introduces a new layer of climate-related financial risk for homeowners. However, it also creates an opportunity. By actively mitigating this effect, you can enhance your property’s ecosystem resilience and market it as a demonstrably cooler, more comfortable, and climate-adapted home.

The solutions lie in smart, sustainable design. Barcelona’s approach provides a city-scale model: by implementing smart irrigation systems that use soil sensors and weather data, the city cut water usage by 25% while greening urban spaces. At the property level, this translates to replacing heat-absorbing concrete with permeable pavers or cool-roof-rated materials and installing smart irrigation. By using simple IoT weather stations to measure and document the temperature reduction before and after such modifications, you can quantify the improvement and present it as a tangible value enhancement to potential buyers.

Key Takeaways

- A property’s long-term value is dictated by its connection to open, scalable infrastructure, not by closed, proprietary smart gadgets.

- Access to and use of open government data for safety, traffic, and services is a new form of due diligence that de-risks real estate investment.

- Climate resilience, achieved through heat island mitigation and smart landscaping, is shifting from an aesthetic choice to a quantifiable economic asset.

How Landscaping Improvements Can Increase Real Estate Valuation by 15%?

Landscaping has always been understood to enhance curb appeal, but in a smart city context, its role is evolving from purely aesthetic to a high-performance ecosystem that delivers measurable economic returns. “Smart landscaping” is about designing an outdoor space that is not only beautiful but also resilient, productive, and efficient. This strategic approach can have a significant impact on a property’s bottom line, with data showing that properties with smart irrigation and sustainable landscaping see up to a 15% valuation increase.

The value is driven by quantifiable improvements in efficiency and resilience. As the following table illustrates, the difference between a traditional garden and a smart ecosystem design is stark. A smart approach leverages technology like IoT soil moisture sensors and weather-data-linked irrigation to dramatically cut water usage and reduce maintenance costs. This creates a more sustainable and cost-effective property, a highly attractive proposition for buyers.

| Feature | Traditional Landscaping | Smart Ecosystem Design |

|---|---|---|

| Water Usage | Standard irrigation | IoT sensors reduce usage by 40% |

| Maintenance Cost | High manual labor | 30% reduction through automation |

| Property Value Impact | 5-7% increase | 12-15% increase |

| Climate Resilience | Limited | Measurable heat reduction |

| Food Production | Ornamental only | Productive micro-farming potential |

Furthermore, this approach adds unique layers of value that go beyond cost savings. The city of Rotterdam, for example, uses green roofs and water-absorbing pavements to fight urban flooding while simultaneously increasing property values. On a residential scale, this means incorporating native plants that support local biodiversity and even creating productive micro-farms. The positive environmental impact of such a garden can be verified and certified through citizen-science apps like iNaturalist, adding a unique and marketable story of ecological contribution to the property’s profile.

Ultimately, navigating the smart city real estate market requires a shift in perspective. The most reliable and enduring value is not found in the surface-level technology that will be obsolete in a few years, but in the deep, structural foundations that ensure a property’s long-term adaptability and resilience. By focusing on the infrastructure backbone, data accessibility, and ecosystem design, you are not just buying a property; you are investing in a future-proof asset. To secure your property’s long-term value, start assessing these invisible infrastructure and ecosystem factors today.